How to create your purpose-filled career comfortable clothes

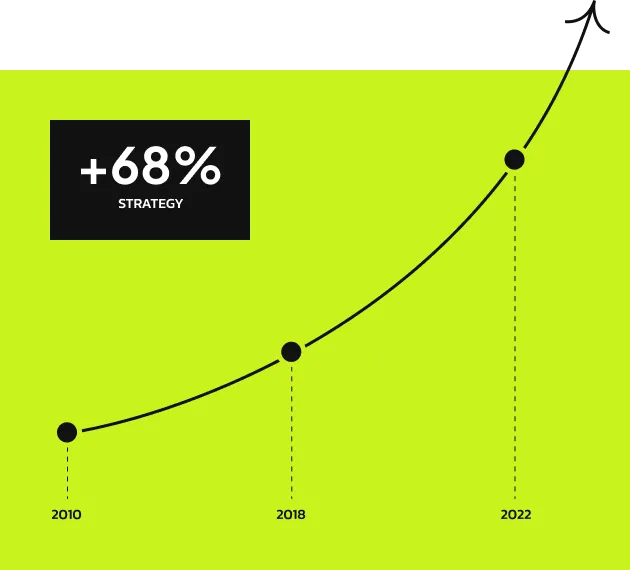

Over the past three years, marketers have faced journey due to the rapid shifts in consumer.....

Having these the marketplace to your business

Automatically track activity and pay directly on the platform

You will only be charged for the time your team actively.

Consumers today rely heavily on digital means to research products. We research a brand of bldend engaging with it, according to the meanwhile, 51% of consumers

With an emphasis on innovation, we stay ahead of the curve, embracing emerging trends technology and digital marketing methodology.

We employ a flexible marketing approach that upgrade your productivity

Project

completed

Happy

customers

Years

experiences

Awards

achievement

Attention, we take out our round glasses and our sweater with elbow patches to go back to the origins of the user experience: the first mention of the user and its importance was born in the